Rare and Out-of-Print Trading, Financial and Stock Market Books

A partial listing of Alanpuri Trading's Private Book Collection, many available for sale. Titles include topics on Technical Analysis, Fundamental Analysis, Business, Economics, Trading Systems (some extremely rare), Monetary Policy, Gold, Futures, Options, Bonds, Asset Bubbles, Trading Psychology, Fibonacci, Banking, Financial Astrology, Gann Theory, Numerology, Wall Street and many other subjects related to successfully trading the financial markets. Additional titles are added every week.

Monday, March 27, 2023

The SRC Blue Book of 3-Trend Cycli-Graphs, Jan. 1982, 12 Years of Pricing, Earnings, Dividends

Thursday, March 23, 2023

The Todd Theory of Market Measurement and Price Projection (1953 Edition)

by F. Payson Todd

Alanpuri Trading, Los Angeles, 2023, Softcover, reprint, exact facsimile of the 1953 edition (27pp.) and the earlier 1952 edition (20pp.) originally self-published by F. (Frank) Payson Todd (1907-1990), 47pp.

Book Condition: New

1953 Contents: Introduction, Key to Terminology, 1. Phases, 2. Legs, 3. Waves, 4. Wavelets, 5. Movements — Price Projection Formula, Reverse Head and Shoulders Pattern, Controversial Interpretations, Examples shown using Dow Jones Industrial Averages, plus additional marketing material by Todd (3 pp.) — end. 27 pp.

1952 Contents: Introduction, Key to Terminology, 1. Phases, 2. Legs, 3. Waves, 4. Wavelets, 5. Movements — Price Projection Formula, Reverse Head and Shoulders Pattern, Controversial Interpretations, Examples shown using Dow Jones Industrial Averages — end. 20 pp.

Summary: (from the Introduction) During the past quarter century of stock market research, this office has continuously studied methods of analysis by which Price Trends could be projected in advance. Such efforts have for the most part fallen into the categories of Time, Price and Volume. This particular study shows how the rise and fall of stock market trends conform to a rhythmic series of Price Patterns. The following charts and pages disclose the conclusions to which we came in regard to our measurements under The Wave Theory, and depict the manner in which the market has responded to our calculations.

$50.00

Wednesday, March 22, 2023

Investing for Profit with Torque Analysis of Stock Market Cycles (1973)

By William C. Garrett

Tuesday, March 21, 2023

A New Approach to Stock Market Timing, A Workbook for Investors

by William I. Ballentine Jr.

Light blue three ring binder with gilt title to cover, loose pages in 3 ring binder, 59 pp., 1985, Illustrated with charts and diagrams,

Book Condition: Very Good, binder covers are rubbed, scuffed and soiled (see photos), these pages are printed on one side, for some pages the ink from the printed pages has marked the blank sides of the previous pages (see photo), this does not affect the readability of the printed pages.

Content: Using the Book, Acknowledgments, Preface,

CHAPTER 1: THE BROAD PICTURE: The Conflict - The Past Action of the Market - The Whole Market - Timing of Buying and Selling

CHAPTER 2: STOCK CHARTS, Types of Charts - Available Publications - Formatting a Chart - Plotting a Chart

CHAPTER 3: TRENDS, Moving Averages vs. Trends - Calculating 10% and 5% Trends - The Value of Trends

CHAPTER 4: TRENDLINES, Defining a Down Trendline - Defining an Up Trendline - Horizontal Trendlines - Temporary Trendlines - The Value of Trendlines

CHAPTER 5: THE BUY SIGNALS, BUY Signals from the Whole Market - RULE 1 - Stock BUY Signals - RULE 2 - Fundamental Confirmation - Acting on the Tie Communication BUY Signal - RULE 3 - Buying Stocks after Intermediate Corrections - Whole Market BUY Signals after Market Corrections - Stock BUY Signals after Market Corrections - Rule 2 vs. the Trap Acting on the Celanese Corp. BUY Signals

CHAPTER 6: THE SELL SIGNALS, SELL Signals from the Whole Market - RULE 4 - Stock SELL Signals - RULE 5 - RULE 6 - RULE 7 - RULE 8 - Fundamental Warning Signals - Acting on the Tie Communication Signal - RULE 9 - Selling Stocks at Market Tops - Stock SELL Signals in a Market Topping Area - RULE 10

CHAPTER 7: OTHER CONSIDERATIONS, High Level Horizontal Corrections - RULE 11 - Selling Short - Don't Buck the Odds - RULE 12

CHAPTER 8: COMPUTER CALCULATIONS, Trend Calculations - Portfolio Calculations - Glossary - References - end. 59 pp.,

RARE content by a relatively unknown Engineering Consultant in Gold Beach, Oregon in 1985. January 1986 Letter to Dr. Baumring asking to sell this work at the Investment Centre Bookstore is also included.

$225.00

Monday, March 20, 2023

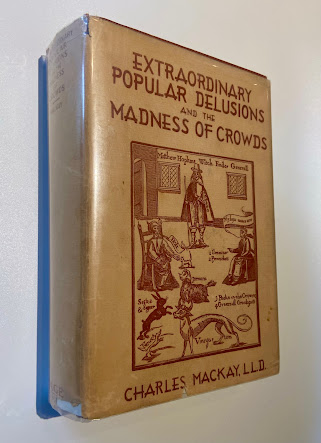

Extraordinary Popular Delusions and the Madness of Crowds

Extraordinary Popular Delusions and the Madness of Crowds

Hardcover, red cloth covers with gilt title to spine, deckled edges, this is the Eighth Impression, April, 1956 of this edition published by L.C. Page & Company (First Impression October 1932)

This edition contains a Foreword by Bernard M. Baruch who coincidently encouraged Louis Coues to publish this important work in 1932. The original versions of this book were published in 1841 and 1852, this copy contains facsimile title pages and reproductions of the original illustrations from editions of 1841 and 1852, 724 pp.,

Book Condition: Good, front and back hinges are cracked, heavily shaken, moderate wear to edges, covers rubbed and scuffed, internally clean and unmarked,

Dust Jacket Condition: Good, (in Mylar), Price intact (NOT price clipped), faded and some light soil, some rips and tears near spine extremes,

Summary: One of the most important books every written on the subject of human folly and the madness of crowds. I particularly like the addition of Baruch's Foreword to this L.C. Page & Company edition. Contents: Publisher's Note, Foreword, Preface, Preface to the edition of 1852, The Mississippi Scheme, The South-Sea Bubble, The Tulipomania, The Alchymists, Modern Prophecies, Fortune-Telling, The Magnetisers, Influence of Politics and Religion on the Hair and Beard, The Crusades, The Witch Mania, The Slow Poisoners, Haunted Houses, Popular Follies of Great Cities, Popular Admiration of Great Thieves, Duels and Ordeals, Relics -- end. 724 pp.

$145.00

S/D 3 Formula 3-81 Trading System (1940s – 1964) by Henry Wheeler Chase

S/D 3 Formula 3-81 Trading System (1940s – 1964) by Henry Wheeler Chase

Alanpuri Trading, Los Angeles, CA, 2022, Hardcover, Reprint, 60 pp., An exact facsimile of this original course material and update bulletins privately published by Henry Wheeler Chase sometime between the mid 1940s and early 1960s. The last update bulletin included in this title is dated December 1963. There are 130 numbered instructions, about 25 pages long, that make up the bulk of the system. Additionally there are 12 pages of “codes” to decipher in order to correctly execute the system. This edition also includes 6 different update bulletins totaling 16 pages. Extremely Scarce Content.

Contents: The S/D 3 Formula 3-81 (Tr. Mk. Reg. U.S. Pat. Off.), The Weekly S/D 3 Record, Preparation of the Weekly S/D 3-81 Record, SECTION 1, Factor One, Factor Two, Factor Three, Factor Four, Factor Five, SECTON 2, Factor Six, Factor Seven, CODE CP Factors 4 and 5 Revised 1963, Examples, CODE CK (re-issued 1964), FACTOR EIGHT, IMPORTANT (Z) POSITION, Measuring Periods, Position Diagrams, RED Position Diagram, BLUE Position Diagram, RELATIVE POSITION KEYS, COMBINATION KEYS, Factor Eight Answer, FACTOR 9, S/D 3-81 ACTION SIGNALS, EXECUTIONS, SUGGESTIONS, CODE PD Position Diagrams for RED and BLUE, CODE PK, CODE PK -0- RED, CODE PK -1- RED, CODE PK -2- RED, CODE PK -3- RED, CODE PK -4- RED, CODE PK -5- BLUE Z, CODE PK -6- BLUE Z, CODE PK -7- BLUE Z, CODE PK -8- BLUE Z, CODE PK -9- BLUE Z, Bulletin #4 BY-PASSING 1957, CODE PK – Bulletin #1 Revised May 1962 (11 pp.), PROTECTIVE STOP BULLETIN #3 Special BUY-STOP (weekly record) June 22, 1962, PROTECTIVE STOP BULLETIN #4 Special SELL-STOP (weekly record) June 22, 1962, PROTECTIVE STOP BULLETIN #5 Arbitrary BS and SS (no date), USE OF THE S/D 3-31 TRADING CONTROL (no date), 3-36 Trading Control Blank Worksheet, Formula S/D 3-81 Computation Blank Worksheet, Instructions, CODE CC-E / CODE VP (SD Formulae), CODE VP December 1963 — end.

Summary: Because Chase never published his work publicly, it is near impossible to find any of his writings although his name is widely know in the trading community. This is the first time this title has been published to the public. It’s extremely rare and multilayered trading system written and updated over the course of many years. We are uncertain if this particular S/D 3 Formula 3-81 system is complete or if there were other update bulletins that we simply don’t have. We’ve done our best to piece it all together. While we can’t imagine anyone using a system like this off-the-shelf, for students of the markets and bored quants this might be a very fun puzzle to play with.

S/D 3 Formula 3-81 Trading System (1940s – 1964) by Henry Wheeler Chase

ISBN: 978-1-945574-53-5

$250

Sunday, March 19, 2023

The Magic T-Theory Forecast, 14 Issues (Jan 1979 to Oct 1979)

The Magic T-Theory Forecast, 14 Issues (Jan 1979 to Oct 1979)

by Terrance Laundry

Forecast Condition: Very Good, some slight wear to edges, but internally clean and unmarked.

Contents: Complete Issues of 14 of Terrence Laundry's Magic T Theory Forecast, Oct 8 1979, Sept 24 1979, Sept 10 1979, Jan 1979 - Introduction to Magic T Theory Part I: The Long Range Ts, Sept 1979 - Introduction to Magic T Theory Part 2: The Magic T Indicators, Aug 20 1979, Jul 6 1979, Jun 18 1979, May 29 1979, May 17 1979, Mar 17 1979, Mar 5 1979, Feb 15 1979, Feb 1 1979, Jan 18 1979 -- end. 116 pp. Extremely RARE original material.

Status: Sold April 2023 to Private Collector in AZ

Sunday, November 23, 2014

Stock Values and Stock Prices: Part I & II (1960) by Nicholas Molodovsky

with additional articles and original signed correspondence

by Nicholas Molodovsky

Book Description: The National Federation of Financial Analyst Societies, New York, 1960. Softcover. 4to - over 9¾ - 12" tall. Saddle Stitch, White paper wrappers with printed black title to covers, published 1960, the article originally appeared in The Financial Analyst Journal, May-June 1960. Part One is 16 pages, Part Two is 9 pages.

Book Condition: Good, foxing and light soil and tanning to covers, some minor damp staining to top corners, rust residue from paperclip to cover of Part Two, on page 9 of Part Two, the publisher has hand pasted a graph over the printed graph and the glue has stained to opposite page, no rips, no tears.

Contents: Stock Values and Stock Prices, here are some of the headings from that article, The Rule of Ten-Times Earnings, Price-Earnings Ratios and Stock Market Levels, A Closer View, Those Tantalizing Ratios, The Province of Price, Operations Research, Capitalized Earnings, Importance of Adequate Concepts, Pioneers of Valuation Studies, The Factor of Time, Earnings are the Dividends' Fund, Some New Findings, Old Names and New, Back to Good Old DJIA, Appraisal of DJIA, Valuation Bases, Rising Levels, Long Cycles and Deep Depressions, A More Hopeful View, Stock Values and Stock Prices, Business Cycles, Supply and Demand, Earnings Growth and Investment Values, Barter Terms, Valuation of DJIA Stocks, Caveat Emptor, Price Orbits, The Problem of Timing, Secular Growth and Cyclical Fluctuations, The Economics of 1960, Beyond the Horizon. --

Also included is a reprint of a Personal Memorandum from Nicholas Molodovsky entitled, "Green Light" dated October 15, 1960 - 8 pages plus foldout chart

Also included is a reprint of his article "It's Good to Own Growth Stocks!" dated March-April 1963 - 17 pages

Also included is a signed personal correspondence to a potential investment client dated April 6, 1961

Very Scarce and Unique Collection of Molodovsky papers. Original Molodovsky titles are extremely hard to find. Collectible.

Status: SOLD Nov 23, 2014 to Private Collector in UK

Friday, August 9, 2013

Marketonics: A Course on the Theory and Practice of Stock Market Trading and Investing by George Seamans Edited by Jack Hellum

by George Seamans Edited by Jack Hellum

Book Description: Alanpuri Trading, Los Angeles, CA U.S.A., 2013. Soft cover, Reprint 4to - over 9¾ - 12" tall. (originally published 1956), original was typewritten on Marketonics letterhead, includes numerous charts, graphs and tables, however this does NOT include the Cycli-Graph Book of Charts referenced in the lectures. 355 pages.

Book Condition: Very Good, corner bumped on top back cover, otherwise appears as new,

Contents: Introduction, Lecture #1: Introduction to course methodology,(10 pages) Lecture #2: (15 pages), Lecture #3: (17 pages), Lecture #4: (14 pages), Lecture #5: (10 pages), Lecture #6: (11 pages), Lecture #7: which includes tables of Advances and Declines (22 pages), Lecture #8: topics include Chart Reading (15 pages), Lecture #9: topics include Trend (15 pages), Lecture #10 more on Chart Reading and Trend (16 pages), Lecture #11: Supply and Demand (14 pages), Lecture #12: Supply and Demand - Continued (18 pages), Lecture #13: Supply and Demand - Continued, The Long Term Trend (24 pages), Lecture #14: Supply and Demand - Continued, The Long Term Trend w/ stock data sheets (19 pages), Lecture #15: Objectives (15 pages), Lecture #16: Objectives - Continued (14 pages), Lecture #17: Long Term Objectives (11 pages), Lecture #18: New System, Lecture #19: Practical Objectives (14 pages), Lecture #20: X-Ray Chart example of 30-Day Supply and Demand Chart set-up (28 pages), Page 1-A: Master Lists; Investment Stocks, Cats and Dogs, Low Priced Stocks, Page 2-A: Master Lists; Volatile Stocks, Steel Stocks, Railroad Stocks, Page 3-A: Master Lists; Heavy Industrial Stocks, Page 4-A: Master Lists; Consumer Stocks, Oil Stocks, Lecture #20 Tables, X-Ray Chart, 9 Groups of Stocks used in the X-Ray Chart from 1949 to 1956, Supply and Demand Chart, Table of Advances and Declines from Lecture #20, Chart: Dow Jones Industrial Average 1951 to 1953, Data Sheets. -- end. Extremely Rare Course in Stock Trading and Investing by George Seamans (edited by George Seamans and Jack Hellum), Highly Collectible REPRINT (note: This reprint of the 20 course lectures does NOT include the accompanying Cycli-Graph book of charts referenced in the material). About the Author: Born in 1889 George Seamans was a well respected trader and author of several stock market books in the 1930s through the 1970s. Titles included, The Seven Pilliars of Stock Market Success (1939), This is the Road to Stock Market Success (1944), Marketonics: A Course on the Theory and Practice of Stock Market Trading and Investing (1956). Seamans first copyrighted the Marketonics Course June 18, 1956. Summary: Extremely Scarce and highly sought after George Seamans title, Highly Collectible Reprint.

Buy Now:

$450.00

Friday, April 26, 2013

The Questioned Stock Manual: A Guide to Determining the True Worth of Old and Collectible Securities

By Albert F. Gargiulo, Rocco Carlucci

Book Description: McGraw-Hill, New York, New York, U.S.A., 1979. Hardcover. 1st Edition. 8vo - over 7¾ - 9¾" tall. Hardcover, light brown boards with black title to spine, First Edition 1979, 193 pp.,

Book Condition: Near Fine,

Dust Jacket Condition: Very Good, (in Mylar), spine faded, light wear to edges, price intact.

Out-of-print.

Buy Now:

$25.00

The Futures Game: Who Wins? Who Loses? and Why?

By Richard J.Teweles, Frank J. Jones, (Editor: Ben Warwick)

Book Description: McGraw-Hill, New York, 1999. Hardcover. 3rd Edition. 8vo - over 7¾ - 9¾" tall. Hardcover, brown boards with gilt title to spine, 3rd Edition, 1999, 676 pp.,

Book Condition: Very Good, corners bumped, previous bookseller label to loose front end papers, light soil to text block, internally clean, bright and unmarked.

Dust Jacket Condition: Very Good, (in Mylar) slightest wear to edges, price intact.

Synopsis: Since it first exploded onto the markets in 1974, THE FUTURES GAME has helped thousands of traders gain an intelligent understanding of futures markets. Over the years, Richard Teweles and Frank Jones have kept their fingers on the pulse of the dynamic futures trading industry, first updating their classic text in 1987. Now, this third edition of THE FUTURES GAME has been completely updated and revised to keep all participants--whether speculators or hedgers, new or veteran--one step ahead of this fast moving, high-stakes game. Combining two decades of strength and wisdom with today's most innovative research and strategic recommendations, this guide to the futures markets continues its reign as the number one tool for futures trading mastery. THE FUTURES GAME, 3rd Edition, walks you through the universe of futures trading possibilities and opportunities, starting with an in-depth discussion of market basics that includes the nature of the contract, the organized markets for those contracts, and the relationship between cash and futures prices. The elements of successful trading are isolated, described, and analyzed to make you familiar with profitable decision-making processes. After that, detailed chapters devoted to particular markets explain price determinants and speculative possibilities within currencies, commodities, and stock index futures. "Notes from a Trader" sections go beyond theory and speculation to provide valuable tips and pointers -- expert guidance you can use to squeeze the maximum benefit from each trade. The comprehensive facts and insights packed into this trader's bible will help you predict what might happen--and why it might happen--in virtually every kind of market. New information in this important third edition includes: Latest research on important topics including efficient market hypothesis, technical and fundamental analysis, and much more. A comprehensive listing of valuable Internet website names and addresses. Stronger emphasis on financial instruments. Innovative strategies for maneuvering through the increasingly important international market. Completely revised sections devoted to Basics of the Game, Playing the Game, How to Win or Lose, Succeeding as a Broker, and Choosing the Correct Markets. Filled with knowledgeable trading strategies and insights, revealing charts on today's most interesting futures markets, and numerous respected trading approaches that will allow you to craft a style based on your own strengths and requirements, THE FUTURES GAME is likely to become the one resource you refer to most often. -- end. 676 pp.

Status: Sold to Private Collector in US

Friday, April 5, 2013

Tubbs' Stock Market Correspondence Lessons: Lessons One to Lesson Fourteen

by Frank H. Tubbs, C. Ralph Dystant

Book Description: Alanpuri Trading, Los Angeles, CA, U.S.A., 2022. Hardcover 4to - over 9¾ - 12" tall. Hardcover, exact facsimile of the 1970 edition published by C. Ralph Dystant's company Dysco, Chicago. Lessons One to Ten were written by Frank Tubbs sometime between the 1930s and 1950 and this made up the original Tubbs Course. Chapters Eleven through Fourteen are believed to have been added by C. Ralph Dystant in his republication of Tubbs work in 1970. Seems that Dystant re-typeset the entire document for the 1970 publication. 203 pp.,

Book Condition: New

Contents: Lesson 1: Trend of the Market, Lesson 2: Groups-Aggregates and Individuals, Lesson 3. Records, Recording, Weeklies, Lesson 4. Charting, Lesson 5. Bases, Heads, Progressions, Swing Rule, Lesson 6. Manipulation, Pools (Sponsor and Active), The Public, Lesson 7. Selection of Trading Stocks, Making Trading a Business, Lesson 8. Resistance and Support Lines. Lesson 9. Investments, Long Move and Fluctuation Trading, Proportion, Lesson 10. Mergers, Auction of New Listings, Lesson 11. Methods, Weekly Record Plan, New Highs and New Lows, Lesson 12. Ideals, Personal Efficiency, Lesson 13. Tape Reading, Lesson 14. Technical Position, Accumulation, Progression and Distribution. -- end. 203 pages. Summary: One of the best trading courses on technical analysis, and trading efficiency. Each lesson ends with a series of good questions to insure the reader understands the section's concepts. Scarce title and still highly requested. Recommended reading. This course was also highly recommended by Dr. Jerome Baumring to his Gann Students in the 1980s.

Buy Now:

$95.00

1929 Revisited, An Economic Handbook for the Turbulent Seventies

by Morgan Maxfield, (with James Gwartney)

Book Description: The National Youth Foundation, Kansas City, 1976. Soft cover. 1st Edition. 8vo - over 7¾ - 9¾" tall. Softcover, Perfect Bound, pictorial graphic and title to front cover, title to spine, Stated First Printing December 1976 (copyright dated 1977 - likely that the copyright submitted in Dec. 76 would not be approved until 1977). 205 pp.

Book Condition: Good, covers extremely rubbed, light soil, corners and spine bumped, spine extremes chipping, text block soiled, internally clean,

Contents: Foreword, Introduction, 1. The Pendulum Era, 2. The Demise of the Post-War Bull Market, 3. Profile of Inflation, 4. Double Digit Deficits and the Economics of Political Expediency, 1967-1970, 5. Interest Rates and the Negative Yield Curve, 6. The Pendulum Swings Again, 1971-74, 7. A Personal Financial Strategy for the Coming Crisis, 8. The Failure of Economics, 9. Wise Men Revisited, 10. A Political Strategy For a Return To Economic Stability, Appendix, Glossary -- end. 205 pp. -- Excellent 1976 discourse by the late great (and forgotten) Morgan Maxfield. Recommended reading.

Buy Now:

$90.00

The Wall Street Jungle

by Richard Ney

Book Description: Grove Press, Inc., New York, 1970. Hardcover. 1st Edition. 8vo - over 7¾ - 9¾" tall. Hardcover, Lime green cloth boards with black title to spine, mustard end papers, First Edition, Stated First Printing, Signed by the Author, 348 pp.

Book Condition: Very good, light soil to top edge, top dust dulled, corners square, internally clean, bright and unmarked,

Dust Jacket Condition: Very Good, (in Mylar), price intact

Contents: 1. The Specialist or Legend of Big Brother, 2. The Specialists Book, 3. Mr. Smith Goes to Washington, 4. Specialists Investment Accounts or Sodom at the Bottom, 5. The Short Sale or When His Cup Runneth Over Watcheth Out, 6. A Telephone Call from Humpty-Dumpty or Mr. X of the SEC, 7. The Financial Elite or Measuring the Stock Exchanges Economic Power, 8. The Paradox of the Federal Reserve System, 9. American Shall Rise Again or The Role of the Stock Exchange Credit and the Morning After, 10. Gluttony on the Bounty or The Big-Block Myth in Exchange Folklore, 11. A case in Point, 12. He Lived Apathy Ever After or Commissioner Sauls Analysis of Specialist Activities Subsequent to President Kennedys Assassination, 13. The Era of American Political Impotence or Paradise Lost, 14. Under the Spreading Apathy or La Dolce Vita in the SEC, 15. The Merits of Speculation, 16. The Challenge, Survival in the Jungle, Its all in the Charts, New Concepts for Portfolio Evaluation, Stock Symbols and Specialist. -- 348 pp. Stated First Printing, Signed by Author, Collectible.

Status: Sold to Private Collector in USA

The Interpretation of Financial Statements

by Benjamin Graham, Charles McGolrick

Book Description: Harper & Row, Publishers, New York, 1975. Hardcover. 3rd Edition. 8vo - over 7¾ - 9¾" tall. Hardcover, black cloth spine, red cloth boards, silver title to spine, Third Revised Edition, 1975, (a revision of the original title published in 1937),

Book Condition: Near Fine, internally clean, bright and unmarked,

Dust Jacket Condition: Good, covers rubbed, scuffed and soiled, price clipped, some chips to edges, Contents: Third Edition of the classic originally written by Benjamin Graham and Spencer B. Meredith. -- 120 pp.

Status: SOLD to private collector in US

Equality and Efficiency, The Big Tradeoff

by Arthur M. Okun

Book Description: The Brookings Institution, Washington D.C., 1975. Hardcover. 1st Edition. 8vo - over 7¾ - 9¾" tall. Hardcover, blue cloth boards, gilt title to spine, red end papers, First Edition, First Printing, 1975, indexed, 124 pp.,

Book Condition: Very Good, spine slightly cocked (about 1/16"), corners square, light shelfwear, internally clean bright and unmarked,

Dust Jacket Condition: Good, some insect damage to edges, price clipped, covers tanned and soil, light wear to edges,

Contents: (from the Foreword), The author feels strongly that "the market needs a place and the market needs to be kept in its place." This recurrent dual them of the book distinguishes Okun both from radical thinkers, who would abolish market capitalism, and from exponents laissez-faire, who would generally broaden its role. Okun values the market as a decentralized and efficient system for spurring and channeling productive effort and for promoting experiment and innovation,; he also sees it as a protector of individual freedom of expression. But he insists that other values must be protected from the potential tyranny of the dollar yardstick and that many rights and powers should not be bought for money. -- end. indexed, 124 pp. -- Interesting read on efficiency from Okun. Recommended Reading.

Status: Sold to Private Collector in USA

A Guide to Profitable Investment

by Harold B. Gruver

Book Description: E.P. Dutton & Co., Inc., New York, 1952. Hardcover. 8vo - over 7¾ - 9¾" tall. Hardcover, red cloth boards with black title to cover and spine, New and Edition with a Supplement on the Mutual Investment Companies, 157 pp.,

Book Condition: Good, corners bumped, covers rubbed and light scuffing, spine bumped, pages tanned and light foxing otherwise interior is clean and unmarked,

Dust Jacket Condition: Fair, price clipped, extreme wear to covers and edges, Contents: Introduction, I. The Business Cycle, II. Yardsticks and Barometers, II. A Fallacy of Profits, IV. Rights and Privileges, V. The Effect of War, VI. Specific of Capital Enhancement, Sum and Substance, Supplement: The Mutual Investment Companies, Informative Survey -- end. 157 pp.

Status: Sold to Private Collector in US.

Know Your Money, How to Know Counterfeit Money, What to Do About It, How to Guard Against Forged Government Checks

by United States Secret Service, Treasury Department

Book Description: Treasury Department, Washington D.C., 1946. Soft cover. 1st Edition. 8vo - over 7¾ - 9¾" tall. Softcover, Saddle Stitch, green paper wrappers, black title to cover, 32 pp., well illustrated,

Book Condition: Very Good, corners bumped, covers rubbed, scuffed and soil, pages lightly tanned otherwise interior unmarked.

Contents: Numerous photos and illustrations, booklet on crime prevention of counterfeiting government notes, headings include, The Secret Service Crime Prevention Program, What is the United States Secret Service?, The Story of Money, Types of Paper Money, Federal Reserve Notes, How to Detect Counterfeit Bills, You Should Know These Faces, Post Notice on or Near Cash Register, The Counterfeit Note Index, From the Secret Service Files, When Money Burns or Wears Out, The Scientific Side, How to Detect Counterfeit Coins, If You Cash a Forged Government Check - You Lose!, The Penalties -- end. 32 pp. Interesting piece on US currency.

Status: Sold to a Private Collector in USA

John A. Pugsley's Common Sense Viewpoint, An examination of current events, public opinion, and political action as viewed in the light of economic reality

by John A. Pugsley

Book Description: Common Sense Press Incorporated, Costa Mesa, CA, U.S.A., 1982. Soft cover. 8vo - over 7¾ - 9¾" tall. Softcover, saddle stitch, printed tan card wrappers with title to cover, Volume VIII, Number 11, November, 1982, 28 pp.,

Book Condition: Very Good, covers rubbed and light soil, internally clean and unmarked,

Contents: The Long Wave, Should we praise of bury Kondratieff?, A critical analysis of the long-wave hypothesis, What Killed the E.R.A.? The E.R.A. advocates defeated themselves with an inconsistent policy on individual rights, Fed Targets Crumble, Volcker admits that M1 doesn't work, and abandons its targets, while Congress urges him on., Easier Money Drives Down Rates, Lower rates will bring out the corporate borrowers., Metals and Interest Rates, The link between metals prices and interest rates is widely misunderstood. -- end. 28 pp. Some great articles from the early 1980s.

Status: Sold to Private Collector in USA

A Post-War History of the Stock Market

by A.G. Ellinger, T.H. Stewart

Book Description: Woodhead-Faulkner Ltd. in association with Investment Research, Cambridge, UK, 1980. Hardcover. 1st Edition. 8vo - over 7¾ - 9¾" tall. Hardcover, red cloth boards with gilt title to spine, First Edition, 1980, indexed, 78 pp,

Book Condition: Near Fine

Dust Jacket Condition: Very Good, small indentation to front cover otherwise near fine

Contents: A post-war history of the London Stock Market, Preface, Introduction, 1. The FT Index 1945-1972, 2. Consols 1945-1972, 3. The FT Industrial Activity Index 1945-1972, 4. The Advance/Decline Line 1960-1972, 5. 1972-1975, 6. 1976-1977, 7. 1978-1979, Summary, Index. -- end. 78 pp.

Status: Sold to Private Collector in USA

The Secret Sexual Life of the Stock Market

by Spencer Fleming (aka: C.M. Flumiani)

Book Description: The Library of Wall Street, Albuquerque, NM, 1970. Soft cover. C.M. Flumiani (illustrator). Reprint. 4to - over 9¾ - 12" tall. Softcover, Reprint, exact facsimile of the original first edition, first printing published in 1970. Numerous scribbled illustrations by Flumiani, 31 pp. Written by Carlo Maria Flumiani under the pseudonym, "Spencer Fleming, pagination is funky, (as expected with Flumiani titles) as the first chapter starts at page 9 even though it's 6 pages in from the front cover, guaranteed complete facsimile of original.

Contents: Chapter 1. Man The Barbarian, 2. The Tyranny of the Emotions, 3. Love and Power, 4. Indifference, Donation & Possession, 5. The Intima & Perversions, 6. Exaggerations and Perversions, 7. Self-Destruction, Life & Sex, 8. Ignorance, Success & Failure, 9. The Stock Market Advances, 10. The Stock Market Declines, 11. The Reclining Positions, 12. The Law of the Extremes, 13. Moronic Beatitudes & Destructive Dejections, 14. Duality: the Double Contrary & the Concordant Action, 15. Sex-for-Pleasure and Sex-for-Procreation, 16. The Rapidity of the Action, 17. Perfection and Imperfection, 18. The Orgasm as a Vaticinatory Experience. -- end. 31 pp. Summary: This 1970 title, published a year after the summer of love, is Flumiani at his eccentric best. The awkward prose and skewed perspectives Flumiani had on the markets in the 60's and 70's are now a welcome diversion to what is otherwise a generally straight jacketed approach by other authors to explain stock market price movement. The Secret Sexual Life of the Stock Market is probably the most entertaining of the Flumiani Collection, and in my opinion actually one of his most coherent. This was the first book Flumiani authored as Fleming, the 2nd was "The Failure of the American Democracy," in 1973, and at least one more in 1977. Extremely Scarce Title, Collectible Reprint.

Buy Now:

$45.00

You Can Win in Wall Street!

by Col. A. G. Rudd

Book Description: The Bookmailer, Inc., Linden, NJ, 1964. Soft cover. 1st Edition. 12mo - over 6¾ - 7¾" tall. Softcover, yellow card wrappers with graphics to cover, raspberry end papers, loose end paper in front and back have uncut edge, Stated First Edition, 1964, 83 pp., 4" x 7", by A.G. (Augustine Goelet) Rudd,

Book Condition: Very Good, some light soil to covers, light tanning to covers, corners gently bumped, internally clean and unmarked, Contents: Foreword, What is Wall Street?, Part I: Learning the Hard Way, Part II: Guideposts, Part III: Building an Investment Fund, Part IV: Looking Ahead -- end. 83 pp. EXTREMELY SCARCE TITLE, Stated First Edition, Highly Collectible.

Buy Now:

$175.00

Guide to Successful Investing

by Roger E. Spear

Book Description: General Features Corporation, New York, 1967. Soft cover. 12mo - over 6¾ - 7¾" tall. Softcover, saddle stitch, orange card wrappers, 1st Edition - 9th Printing November, 1967, 48 pp., 5" x 7",

Book Condition: Very Good, light soil to covers, covers faded, spine faded, corners lightly bumped, general shelfwear, internally clean and unmarked,

Contents: Chapter 1, Establish an Investment Objective, 2. Choose Your Kinds of Stocks, 3. The Mechanics of Investing, 4. How to Time Your Purchases, 5. Inflation and Stock Prices, 6. Defining Fixed Income Securities, 7. An Assessment of Mutual Funds, 8. Pitfalls for the Unwary, 9. Answers to Nine Commonly Asked Questions, 10. Where Do You Get Investment Help?, 11. What Should You Expect From Stocks? -- 48 pp. Scarce Title.

Status: Sold to Private Collector in USA

How to Invest in Strategic Metals

by Bohdan O. Szuprowicz

Book Description: St. Martin's Press, New York, 1982. Hardcover. 1st Edition. 8vo - over 7¾ - 9¾" tall. Hardcover, black boards with gilt title to spine, Stated First Edition, First Printing, 1982, 227 pp., w/ Dust Jacket,

Book Condition: Very Good, corners square, slightest hint of wear, internally clean, bright and unmarked,

Dust Jacket Condition: Very Good, (in Mylar), price clipped, slight tanning to interior tabs, slightest wear to edges,

Contents: (from the preface), This book is designed to lay bare all the facts and shatter the illusions about strategic metals investment. It has been written with the average investor in mind, but brokers, dealers, traders, and corporate executives should find it equally useful because it describes a new and recent development on the investment scene that has hitherto dong almost undocumented. -- 227 pp., Scarce First Edition, First Printing with Dust Jacket.

Buy Now:

$45.00

The Midas Touch

by John Train

Book Description: Harper & Row, Publishers, New York, 1987. Hardcover. 1st Edition. 8vo - over 7¾ - 9¾" tall. Hardcover, black cloth board with gilt title to spine, State First Edition, Indexed, 207 pp.,

Book Condition: Good, spine slightly cocked (about 1/16"), corners gently bumped, light shelfwear, a few pages have penciled notes,

Contents: In The Midas Touch, author John Train analyzes the investment principles of America's most successful Investor - Warren Buffet. 207 pp.

Status: Sold to Private Collector in USA

Modern Money: A Treatise on the Reform of the Theory and Practice of Political Economy

by Lord Melchett

Book Description: Martin Secker, London, 1932. Hardcover. 1st Edition. 8vo - over 7¾ - 9¾" tall. Hardcover, blue cloth boards blind stamped borders with gilt title to spine, top edge black, uncut edges, First Edition, 1932, Indexed, 278 pp.,

Book Condition: Good, corners bumped, frayed and boards exposed, spine bumped, covers rubbed, scuffed and light soil, previous owner stamp to front end papers and back end papers, pages tanned otherwise clean and unmarked, no dust jacket,

Contents: Introduction, I. Analysis, II. Currency and Banking, III. National and International Money, IV. Stocks, Their Value and Their Effects, V. Industry, VI. Empire, VII. Politics, VIII. The Human Future, IX. Synthesis, Bibliography, Index. -- end. 278 pp., FIRST EDITION.

Buy Now:

$30.00

Stock Market Psychology

by E.M. Zimmerman

Book Description: Alanpuri Trading, Los Angeles, CA, U.S.A., 2013. Soft cover. Reprint. 4to - over 9¾ - 12" tall. Softcover, Reprint, exact facsimile of the Original 1925 First Edition published by American Securities Service Incorporated.

Book Condition: New

Contents: Chapter I. WHAT MAKES THE MARKET, What Is the Market?, Opinions Expressed in Buying and Selling, II. WHY PEOPLE ENTER THE MARKET, Something for Nothing? Mistaken Concept of Market, Becoming a Partner, The Gain of Money Motive, III. CROWD PSYCHOLOGY, Who the "Public" Is, The Market a Merchandising Proposition, Mental Intoxication of a Big Paper Profit, Missing a Big Profit, Cutting Losses Short Contrary to Human Nature, IV. MENTAL ATTITUDE OF THE PUBLIC IN DISLIKING SHORT SELLING, Relatively Few Persons Sell Short, Every Contractor Sells Short, Nothing Unethical in Short Selling, The Short-The Quick Profit Side of the Market, Why Public Not Educated to Short Selling, Being Short Inducing Fear, V. INTERPRETATION OF THE NEWS, Trying to Speculate on Past Events, Discounting Conditions Marketwise, Reading Between the Lines, Market Thrives on Mystery, Changing Status of Security Markets, VI. ACCUMULATION AND DISTRIBUTION AMMUNITION, When Distribution Is Easy, Bull News at the Top, Psychological Effect of Stock Dividends, Ammunition Used in Accumulation, Mergers as Bull Ammunition, Interesting Cases Cited, VII. THE MOMENTUM OF CROWD PSYCHOLOGY, Can You Keep On An Even Keel?, Bullishness or Bearishness - Extremes, You Have Plenty of Company, Buying Contagion Spreads Rapidly, The Mind's Love of Self-Appropriation, VIII. PSYCHOLOGICAL EFFECT OF THE INDIVIDUAL'S MARKET POSITION, Does Your Position Warp Your Mind?, Seeing Through Colored Spectacles, Blue Tinted Lenses of the Bear, Fighting the Rise, Going With the Market, Maintaining a Disinterested Viewpoint, Constitutional Bullishness or Bearishness, IX. PSYCHOLOGY OF REPETITION OF MARKET BEHAVIOR, "Habits" of Stocks, Operation of Pools, Buying Low - Selling High, Going Contrary to the Graph, Market Graph - Market Psychology Visualized, X. ADVANTAGEOUS AND ERRONEOUS MENTAL ACTIVITIES, Common-Sense Qualities You Need, Convictions and the Courage to Back Them, Forming Correct Decision Quickly, When Market Backs and Fills, Patience - Patience - Patience, Planning Soundly Ahead Now - end. 42 pp. This title was one of the first books ever specifically written about Stock Market Psychology. Keeping in mind that this book was written 4 years before the 1929 crash, it's amazing that Zimmerman was able to be so spot-on in his observations. Of course, now eighty-five plus years later, nothing has changed in terms of human behavior and thus his insights are still a valuable references to review from time to time. Extremely Scarce Title, Reprint, Recommended Reading. 42 pp.

Buy Now:

$30.00

Pythagorean Numerology, Some notes on numbers, letters, dates and places (ORIGINAL TYPEWRITTEN MANUSCRIPT)

by Manly P. Hall

Book Description: 1941. No Binding, 4to - over 9¾ - 12" tall. ORIGINAL TYPEWRITTEN MANUSCRIPT (typed by his assistant Virginia B. Pomeroy), Notes on a lecture by MANLY P. HALL, Contents are from a lecture January 19, 1941 in Los Angeles, California., 13 pp.,

Condition: Good, some chipping to edges, pages extremely tanned, paper clip rust mark to top left corner, author / typist penciled notes and corrections throughout,

Contents: A thought provoking text on numerology and Universal Law by Hall, here's the first paragraph, "I do not believe there is any philosophy in the world that gives us such a wonderful working knowledge of principles as the doctrines of Pythagoras. In his mathematical philosophy Pythagoras reveals very closely the relationship between the great Universal Laws governing life and the application of these Laws to the affairs of men. First of all it clearly indicates that everywhere in nature, everywhere in the life of the human being, the various things that we see, the phenomenon of living as we know it, every part is directly related to a Universal Reality. Forms are symbols of ideas.

Human beings are symbols of cosmic motion, we are a part of the motion of the Universe through Space. The individual purpose of man, his arts, crafts, trades and professions, are symbols of the extension of his soul power. Everything that the individual does as an individual is a symbol of the principles working through him. All these principles are of themselves invisible but are apparent to us in the outworking of themselves in our patterns of life and action." -- Hall was a friend of R.N. Elliott and had a profound influence on Elliott's understanding of Universal Law which Elliott later characterized in his book, "Nature's Law: The Secret of the Universe (1946)". 13 pp. Highly Collectible Original Typewritten Manuscript.

Buy Now:

$540.00

Thursday, April 4, 2013

Deregulating Wall Street, Commercial Bank Penetration of the Corporate Securities Market

by Ingo Walter (editor)

Book Description: John Wiley & Sons (Wiley-Interscience Publication), New York, 1985. Hardcover. 1st Edition. 8vo - over 7¾ - 9¾" tall. Hardcover, blue boards with gilt title to spine, First Edition, 1985, indexed, 315 pp.

Book Condition: Very Good, light wear to exterior, interior clean, bright and unmarked, Dust Jacket Condition: Very Good, light wear to edges, spine and cover light fading and light tanning, price intact, light soil,

Contents: 1. Introduction and Overview, 2. On the Expansion of Banking Powers, 3. Legislative History of Glass-Steagall Act, 4. An Economic Evaluation of Bank Securities Before 1933, 5. An Analysis of the Competitive Effects of Allowing Commercial Bank Affiliates to Underwrite Corporate Securities, 7. Bank Safety and Soundness and the Risks of Corporate Securities Activities, 8. Conflicts of Interest: An Economic View, 9. Conflicts of Interest: A Legal View, 10. A View from the International Capital, 11. Summary and Implications for Policy, Index. -- end.

Status: Sold to Private Collector in USA

Wednesday, March 20, 2013

Cyclical Market Forecasting Stocks and Grain

by James Mars Langham

Book Description: Alanpuri Trading, Los Angeles, CA, U.S.A., 2013. Soft cover. Reprint. 4to - over 9¾ - 12" tall. Softcover, Reprint, Exact facsimile of the Original 1938 First Edition, 191 pp., This is Langham's second book, a follow up to "Planetary Effects on Stock Market Prices" published in 1932.

Book Condition: Fine

Contents: Preface,

CHAPTER I: Explanation of how the described planetary effects on economic trends are based solely on tabulated records of the past 75 years that prove it,

CHAPTER II: Preliminary technical information. A nautical almanac or ephemeris needed. Where to get it and how to read it. An explanation of which aspects are bullish and which bearish. The cyclical period of each planet and two combined,

CHAPTER III: Major market trends and which planet combinations cause them. The best and strongest long pull indicator. Another very reliable repeating indicator.

Chapter IV: Chain Effect. Explanation of the great power and influence of a chain or sequence of planetary formations. When major trends start and when finally end.

Chapter V: Other long term indicators. Angular signs. Transits. The indications of a Neptune combination from 1939 to 1943, a first promise then a warning. Heliocentric positions and their effects. Explanation of big chart, showing trend of Dow-Jones Industrial Averages compared to planetary positions, and prevailing sun-spots, in detail from 1900 to 1938.

CHAPTER VI: Sun Spots. Solar Radiation. Ultra-Violet Rays. The correlation of sun-spots to economic trends for last 50 years. How the sun-spot theory relates to the planetary theory.

CHAPTER VII: Short Swing Indicators. What minor planets indicate the short swings. Tablulated records show a startling verification. Breeders and exciters.

CHAPTER VIII: Tape indications. Numerous examples of how the termination of line formations and the direction immediately following, diverging averages and triple tops, has been foretold by coinciding or approaching major and minor planetary formation.

CHAPTER IX: Eclipses, Ingresses, and Lunations. Their market interpretation explained and illustrated by many charts including the following: New Moon 9/3/29 - Why the panic started, Fall Ingress 9/23/29 - Why the panic continued, Eclipse 8/31/32 - Resumed declines and eclipse of Republican Party, New Moon 3/25/33 - Why and inflationary bull market began, New Moon 4/24/33 - Why inflation took public hold, New Moon 4/13/24 - Why drought was indicated and market declines, New Moon 4/3/35 - An exciter, or set-off, of a major bull market,

CHAPTER X: Grain Forecasting. Indications of seasonal weather and crop yields. The grain Key Points of the Zodiac. Indications of sufficient rainfall or drought. The wheat belt of the United States. Indications for Argentina and Australia. 10 charts illustrate and explain why 1934 and 1936 were drought years and why 1937 and 1938 had big yields. Short swing indicators.,

CHAPTER XI: Description of a market advisory service. Annual and weekly bulletins. Reproduction of the 1938 Trend Chart that was drawn, issued, and copyrighted one year in advance in December 1937.,

CHAPTER XII: Detailed instructions on how to erect ingress or lunation charts for any date.,

CHAPTER XIII: Ephemeris giving Geocentric Longitudes of Neptune, Uranus, Saturn, Jupiter, and Mars for the first of each month from 1900 to 1950. -- end.

Softcover, 191 pp. Extremely Scarce Content. Collectible Reprint.

Buy Now:

$125.00

The SRC Blue Book of 3-Trend Cycli-Graphs, Jan. 1982, 12 Years of Pricing, Earnings, Dividends

The SRC Blue Book of 3-Trend Cycli-Graphs, Jan. 1982, 12 Years of Pricing, Earnings, Dividends by Securities Research Company Softcover, car...

-

PART 1: Baumring Scientific & Metaphysical Reading List PART 2: Baumring Financial Market Reading List, Primary Recommendations PART...

-

Tubbs' Stock Market Correspondence Lessons: Lessons One to Lesson Fourteen by Frank H. Tubbs, C. Ralph Dystant Book Description: Ala...

-

The Intelligent Chartist by John W. Schultz Book Description: WRSM Financial Services, New York, NY, 1962. 4to - over 9¾ - 12" tall. S...